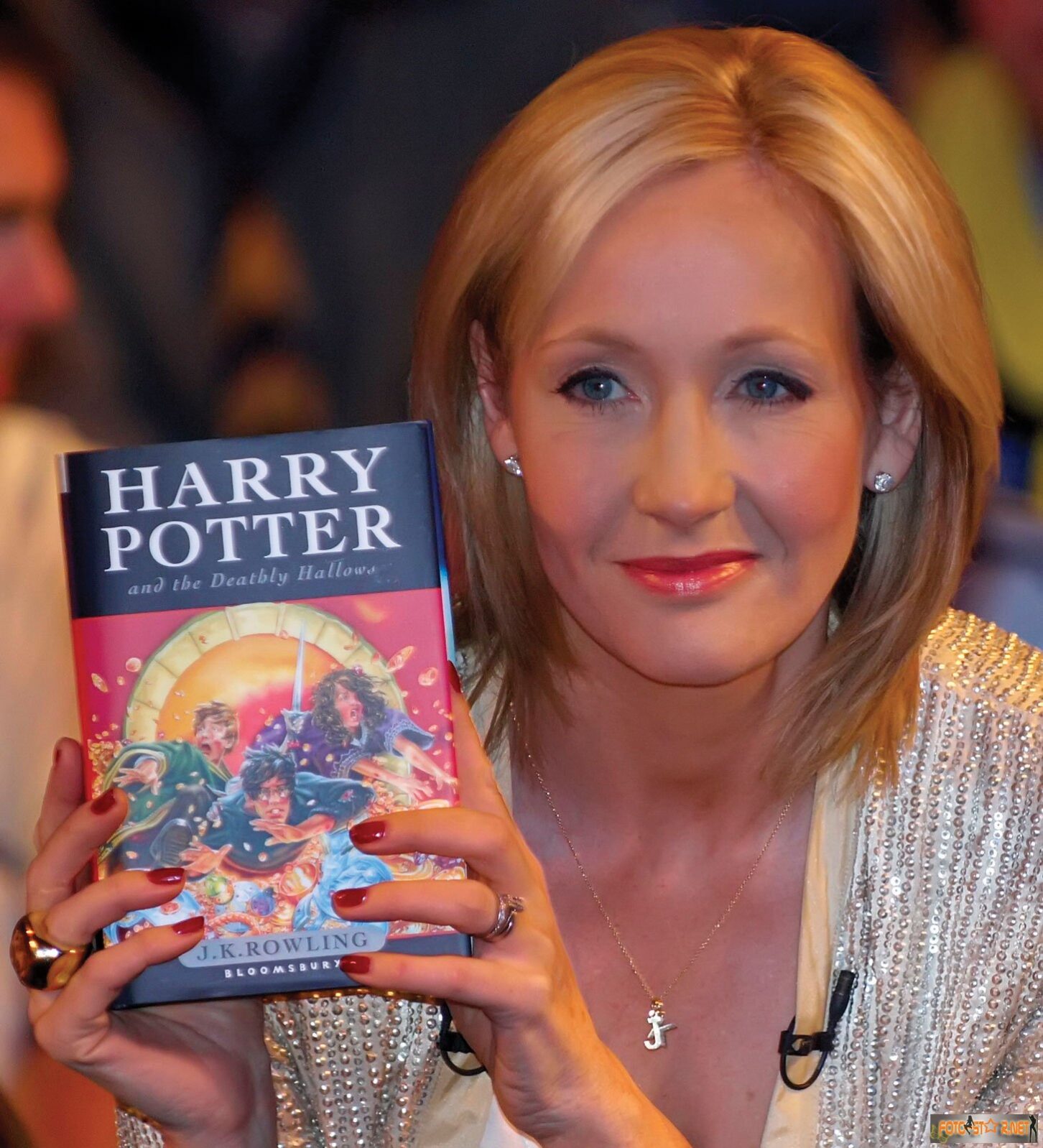

It is a popular theme these days to bash capitalism and idea creators as if their abilities to improve their own status somehow harms someone else. This article by University of Georgia economist Jeffrey Dorfman explains why those who bash capitalism and idea creators fail to make their case, with a nod to “Harry Potter” author J.K. Rowling.

By Jeffrey Dorfman

By Jeffrey Dorfman

Thanks to Thomas Piketty and his book, Capital in the Twenty-First Century, the topic of the day in political discussions is income inequality. What is most fascinating about this discussion is how many of the facts and commonly accepted wisdoms employed to support the arguments in this debate are wrong. This column will point out some of the main ones, so that at least we can have a debate based on a common set of (hopefully correct) facts.

As a quick summary, here are the actual facts: spendable income inequality is not increasing, increased capital is not bad for labor, wealth is not a zero sum game, and high income taxes do not necessarily lead to a more equal outcome. On all four of these items, the mainstream beliefs are wrong.

First, income inequality is increasing only if you measure before-tax income. That is, all of Piketty’s data, charts, and recommendations are based on what economists call market income. It is as if governments around the world either did not exist or had not been busy addressing this problem until Piketty wrote a book about it.

If one looks at after-tax income, the increase in income inequality over time is greatly reduced. If one goes further and factors in the government’s attempts to redistribute income, income inequality is not increasing in the U.S. at all. This after-tax, after-transfer income essentially is a measure of how much stuff you can consume (either by buying it or because somebody gave you free stuff). And, as demonstrated below by Gary Burtless of The Brookings Institution (a center-left think tank), income inequality measured this way has actually decreased in the U.S. over the decade from 2000-2010. A chart from Burtless is included here:

To me, and I suspect most people, this is the more correct way to look at income if one is studying income inequality because this measure is the one that affects people’s actual, real-life situation. It may be of some interest to study the pre-tax and pre-transfer income distribution and its changes over time, but that is only relevant for deciding if government intervention is still needed. To see if government policy is working, in the sense of accomplishing its goals, it is the after-tax, after-transfer income distribution that must be consulted.

Second, a main contention in Piketty’s book is that capital is increasing faster than GDP and that this means labor is losing to capital in share of GDP earned. Piketty believes this means that income and wealth inequality will inevitably continue to grow unless we do something about it. Obviously, one rebuttal is the above chart, which shows that the U.S. government has already done something about income inequality if one looks at the right data. An additional problem with Piketty’s argument is that his capital measure includes residential real estate. Thus, as homes in many developed countries increased in value over the twenty-five years from 1980-2005, capital as Piketty measured it increased greatly, yet much of these gains to “capital” went to middle-class homeowners, not the rich.

Second, a main contention in Piketty’s book is that capital is increasing faster than GDP and that this means labor is losing to capital in share of GDP earned. Piketty believes this means that income and wealth inequality will inevitably continue to grow unless we do something about it. Obviously, one rebuttal is the above chart, which shows that the U.S. government has already done something about income inequality if one looks at the right data. An additional problem with Piketty’s argument is that his capital measure includes residential real estate. Thus, as homes in many developed countries increased in value over the twenty-five years from 1980-2005, capital as Piketty measured it increased greatly, yet much of these gains to “capital” went to middle-class homeowners, not the rich.

Another point that seems missing from this argument is that capital is actually good for labor. When the capital-to-labor ratio is increased, basic economics teaches us that labor becomes more productive and, thus, can be paid more. In fact, this is the universally accepted explanation for the high wages American workers enjoy relative to so many other countries. There is no reason to assume that increased capital is bad for income inequality. Yes, capital owners will receive returns to capital, but the workers that are made more productive can also capture returns in the form of higher wages.

This leads nicely into the third point: wealth is not a zero sum game. This is economist jargon meaning everyone can win. Look again at the chart Gary Burtless put together. You will note that all segments of American society saw their incomes rise except the top one percent. If we had the data to do the chart again through 2014, we would see that everybody had higher incomes than fifteen years ago.

And this win-win idea is not just in terms of income. In a capitalist society, people get rich by making somebody else better off. J. K. Rowling became one of the richest women in the world by writing the Harry Potter series of books. All the people who bought the books believed that the books were worth more than the sale price otherwise they would not have bought it. Thus, J.K. Rowling wins and all her readers win. Both sides of a voluntary transaction are made better off. As long as government coercion is not involved, when you see someone getting rich, you know a lot of people are being made happy.

Finally, the idea that higher income taxes on the wealthy will reduce income inequality is wrong, at least in the sense of the pre-tax income that Piketty presents. As shown by the Economist magazine, after taxes the U.S. and United Kingdom end up with almost exactly equal income distributions, the U.K. has a more progressive income tax system than the U.S. (meaning it collects a higher percentage from higher income people), but the U.K. has higher income inequality when measured on pre-tax income than the U.S. While Britain appears to be working harder to reduce income inequality through taxes than the U.S., pre-tax income inequality still exists. Similarly, Sweden, famous for its high taxes on the rich and supposedly more uniform economy, actually has just as much pre-tax income inequality as the U.S.

In reality, government can redistribute income through taxes and transfer payments, but the poor are only made better off as long as the transfers continue. Without continual redistribution, these countries would be just as unequal as before all the redistribution started.

It is the age old problem, stated in the famous Chinese proverb, “Give a man a fish; you have fed him for a day. Teach a man to fish; and you have fed him for a lifetime.” Piketty and all his liberal fans think they can solve the problem by giving the poor more fish while conservatives know the true solution lies in providing each person the opportunity to create their own economic success. Let’s stop worrying about how many fish other people have and simply give the poor the tools to catch their own fish.

(Jeffrey Dorfman is a University of Georgia professor of agricultural and applied economics. The views in this article are those of the author and not the Georgia Public Policy Foundation. This article was originally published by Forbes.com.)

By Jeffrey Dorfman

By Jeffrey Dorfman

Thanks to Thomas Piketty and his book, Capital in the Twenty-First Century, the topic of the day in political discussions is income inequality. What is most fascinating about this discussion is how many of the facts and commonly accepted wisdoms employed to support the arguments in this debate are wrong. This column will point out some of the main ones, so that at least we can have a debate based on a common set of (hopefully correct) facts.

As a quick summary, here are the actual facts: spendable income inequality is not increasing, increased capital is not bad for labor, wealth is not a zero sum game, and high income taxes do not necessarily lead to a more equal outcome. On all four of these items, the mainstream beliefs are wrong.

First, income inequality is increasing only if you measure before-tax income. That is, all of Piketty’s data, charts, and recommendations are based on what economists call market income. It is as if governments around the world either did not exist or had not been busy addressing this problem until Piketty wrote a book about it.

If one looks at after-tax income, the increase in income inequality over time is greatly reduced. If one goes further and factors in the government’s attempts to redistribute income, income inequality is not increasing in the U.S. at all. This after-tax, after-transfer income essentially is a measure of how much stuff you can consume (either by buying it or because somebody gave you free stuff). And, as demonstrated below by Gary Burtless of The Brookings Institution (a center-left think tank), income inequality measured this way has actually decreased in the U.S. over the decade from 2000-2010. A chart from Burtless is included here:

To me, and I suspect most people, this is the more correct way to look at income if one is studying income inequality because this measure is the one that affects people’s actual, real-life situation. It may be of some interest to study the pre-tax and pre-transfer income distribution and its changes over time, but that is only relevant for deciding if government intervention is still needed. To see if government policy is working, in the sense of accomplishing its goals, it is the after-tax, after-transfer income distribution that must be consulted.

Second, a main contention in Piketty’s book is that capital is increasing faster than GDP and that this means labor is losing to capital in share of GDP earned. Piketty believes this means that income and wealth inequality will inevitably continue to grow unless we do something about it. Obviously, one rebuttal is the above chart, which shows that the U.S. government has already done something about income inequality if one looks at the right data. An additional problem with Piketty’s argument is that his capital measure includes residential real estate. Thus, as homes in many developed countries increased in value over the twenty-five years from 1980-2005, capital as Piketty measured it increased greatly, yet much of these gains to “capital” went to middle-class homeowners, not the rich.

Second, a main contention in Piketty’s book is that capital is increasing faster than GDP and that this means labor is losing to capital in share of GDP earned. Piketty believes this means that income and wealth inequality will inevitably continue to grow unless we do something about it. Obviously, one rebuttal is the above chart, which shows that the U.S. government has already done something about income inequality if one looks at the right data. An additional problem with Piketty’s argument is that his capital measure includes residential real estate. Thus, as homes in many developed countries increased in value over the twenty-five years from 1980-2005, capital as Piketty measured it increased greatly, yet much of these gains to “capital” went to middle-class homeowners, not the rich.

Another point that seems missing from this argument is that capital is actually good for labor. When the capital-to-labor ratio is increased, basic economics teaches us that labor becomes more productive and, thus, can be paid more. In fact, this is the universally accepted explanation for the high wages American workers enjoy relative to so many other countries. There is no reason to assume that increased capital is bad for income inequality. Yes, capital owners will receive returns to capital, but the workers that are made more productive can also capture returns in the form of higher wages.

This leads nicely into the third point: wealth is not a zero sum game. This is economist jargon meaning everyone can win. Look again at the chart Gary Burtless put together. You will note that all segments of American society saw their incomes rise except the top one percent. If we had the data to do the chart again through 2014, we would see that everybody had higher incomes than fifteen years ago.

J. K. Rowling

And this win-win idea is not just in terms of income. In a capitalist society, people get rich by making somebody else better off. J. K. Rowling became one of the richest women in the world by writing the Harry Potter series of books. All the people who bought the books believed that the books were worth more than the sale price otherwise they would not have bought it. Thus, J.K. Rowling wins and all her readers win. Both sides of a voluntary transaction are made better off. As long as government coercion is not involved, when you see someone getting rich, you know a lot of people are being made happy.

Finally, the idea that higher income taxes on the wealthy will reduce income inequality is wrong, at least in the sense of the pre-tax income that Piketty presents. As shown by the Economist magazine, after taxes the U.S. and United Kingdom end up with almost exactly equal income distributions, the U.K. has a more progressive income tax system than the U.S. (meaning it collects a higher percentage from higher income people), but the U.K. has higher income inequality when measured on pre-tax income than the U.S. While Britain appears to be working harder to reduce income inequality through taxes than the U.S., pre-tax income inequality still exists. Similarly, Sweden, famous for its high taxes on the rich and supposedly more uniform economy, actually has just as much pre-tax income inequality as the U.S.

In reality, government can redistribute income through taxes and transfer payments, but the poor are only made better off as long as the transfers continue. Without continual redistribution, these countries would be just as unequal as before all the redistribution started.

It is the age old problem, stated in the famous Chinese proverb, “Give a man a fish; you have fed him for a day. Teach a man to fish; and you have fed him for a lifetime.” Piketty and all his liberal fans think they can solve the problem by giving the poor more fish while conservatives know the true solution lies in providing each person the opportunity to create their own economic success. Let’s stop worrying about how many fish other people have and simply give the poor the tools to catch their own fish.

Jeffrey Dorfman is a University of Georgia professor of agricultural and applied economics. The views in this article are those of the author and not the Georgia Public Policy Foundation. This article was originally published by Forbes.com.