The proposals could drop the personal income tax rate from 6% to 5%.

Senate Finance Committee Chairman Judson Hill recently introduced two tax reform bills. The first proposal would replace Georgia’s six tax brackets with one tax bracket of 5.4 percent (a reduction of 10 percent from the current top rate of 6 percent), increase personal and dependent exemptions by $2,000 each, and eliminate itemized deductions other than charitable deductions, medical expenses and up to $25,000 of mortgage interest. In addition, the corporate net worth tax is eliminated. [Update: Analysis of this bill by the Tax Foundation indicates it would improves Georgia’s ranking to 18th overall on the State Business Tax Climate Index, up from the current ranking of 39th.]

The second bill, a proposed constitutional amendment, would reduce the personal income tax rate to 5.2 percent and then to 5.0 percent contingent on state revenues and the Rainy Day Fund meeting specific targets.

How does Georgia’s top marginal personal income tax rate compare to other states? In the Southeast, only South Carolina’s top rate of 7 percent is higher than Georgia. Nationally, 28 states have lower marginal rates.

28 States with Personal Income Tax Rates Lower Than Georgia

| Alaska – 0%

Florida – 0% Nevada – 0% New Hampshire – 0%* South Dakota – 0% Tennessee – 0%* Texas – 0% Washington – 0% Wyoming – 0% Pennsylvania – 3.07% North Dakota – 3.22% |

Indiana – 3.3%

Illinois – 3.75% Michigan – 4.25% Arizona – 4.54% Kansas – 4.6% Colorado – 4.63% New Mexico – 4.9% Alabama – 5% Mississippi – 5% Utah – 5% Massachusetts – 5.15% |

Oklahoma – 5.25%

Ohio – 5.33% North Carolina – 5.499% Maryland – 5.75% Virginia – 5.75% Rhode Island – 5.99% Georgia – 6% Kentucky – 6% Louisiana – 6% Missouri – 6% |

| * NH and TN tax interest and dividends only (not wages). | ||

Although similar to the recommendations of the 2010 Special Council on Tax Reform and Fairness for Georgians and the tax reforms implemented in North Carolina, these proposals are more limited in scope.

Comparing Tax Reform Proposals

| North Carolina 2013 and 2015 Reforms | Georgia Tax Reform Council Recommendations | Georgia Current Law | 2016 Georgia Proposal | |

| Income Tax Brackets | 1 | 1 | 6 | 1 |

| Income Tax Rate(s) | 5.499% | 5% declining to 4% | 1%-6% | 5.4% declining to 5.0% if revenue triggers are met |

| Itemized Deductions | Limited to charitable deductions, medical expenses and up to $20,000 of mortgage interest and real property taxes | Eliminate | Limited to charitable deductions, medical expenses and up to $25,000 of mortgage interest | |

| Standard Deduction | More than doubled to $15,500 for married couples | Eliminate | No change | |

| Personal Exemptions | Eliminated | Eliminate | Increased by $2,000 | |

| Dependent Deduction | Eliminated | Reduce to $2,000 | Increased by $2,000 | |

| Corporate Income Tax Rate | 5% declining to 3% in 2017 if revenue trigger is met | Same as Personal Income Tax rate | 6% | No change |

| Estate Tax | Eliminated | Already eliminated | ||

| Food for Home Consumption (Groceries) | Not taxed | Eliminate exemption | No change (exemption remains in place) | |

| Sales Tax Rate | No change | No change | No change | |

| Sales Tax on Services | Modest expansion to tax service contracts and repair or maintenance services | Tax selected personal and household services | No change | |

| Sales Tax Holiday | Eliminated | Eliminate | No change |

The IRS publishes personal income tax data for each state here. Based on that information, it is possible to calculate the average mortgage interest deduction and average charitable gift deduction for Georgia taxpayers by income. A breakout of medical expense deductions is not available at the state level, so these must be estimated using federal data. The average mortgage interest deduction for the highest income category (adjusted gross income of $1 million or more) is below the proposed cap of $25,000.

| $1 under $10,000 |

$10,000 under $25,000 |

$25,000 under $50,000 |

$50,000 under $75,000 |

$75,000 under $100,000 |

$100,000 under $200,000 |

$200,000 under $500,000 |

$500,000 under $1,000,000 |

$1,000,000 or more |

|

|---|---|---|---|---|---|---|---|---|---|

| Average mortgage interest deduction (Actual GA data) | $7,035 | $6,188 | $5,892 | $6,502 | $7,300 | $8,817 | $13,121 | $18,987 | $22,082 |

| Average charitable gift deduction (Actual GA data) | $1,654 | $2,679 | $3,402 | $3,810 | $4,280 | $5,347 | $9,948 | $30,757 | $170,218 |

| Average allowable medical expense deduction (Estimate based on federal data) | $6,022 | $2,770 | $2,639 | $2,409 | $1,580 | $1,017 | $700 | $552 | $663 |

The table below shows how the taxable income for a family of four in different income categories would change after the proposed tax reform. This shows a reduction in taxable income for families with income below $100,000. The higher income families would see a net increase in their taxable income, but would also benefit the most from the tax rate reduction.

| $1 under $10,000 |

$10,000 under $25,000 |

$25,000 under $50,000 |

$50,000 under $75,000 |

$75,000 under $100,000 |

$100,000 under $200,000 |

$200,000 under $500,000 |

$500,000 under $1,000,000 |

$1,000,000 or more |

|

| Average adjusted gross income (AGI) | $5,597 | $16,947 | $35,825 | $61,379 | $86,562 | $134,542 | $283,801 | $673,029 | $2,523,556 |

| Current personal exemptions and dependent deductions | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 |

| Current average itemized deductions | $14,441 | $14,058 | $15,525 | $19,910 | $20,256 | $25,414 | $43,756 | $91,983 | $331,490 |

| Current estimated taxable Income | $0 | $0 | $6,900 | $28,069 | $52,906 | $95,728 | $226,645 | $567,646 | $2,178,667 |

| After Proposed Tax Reform: | |||||||||

| Increased personal exemptions and dependent deductions | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

| Reduced itemized deductions | $0 | $2,422 | $3,592 | $7,189 | $7,097 | $10,233 | $19,986 | $41,687 | $138,527 |

| Net change in estimated taxable income after tax reform | -$8,000 | -$5,578 | -$4,408 | -$811 | -$903 | $2,233 | $11,986 | $33,687 | $130,527 |

So under this proposal, an average family of four that itemizes would pay no tax on the first $34,000 of income. (Median household income in Georgia is around $49,000. The total deductions and exemptions from the third and fourth columns in the tables above under this proposal are $34.121 and $34,559, respectively.)

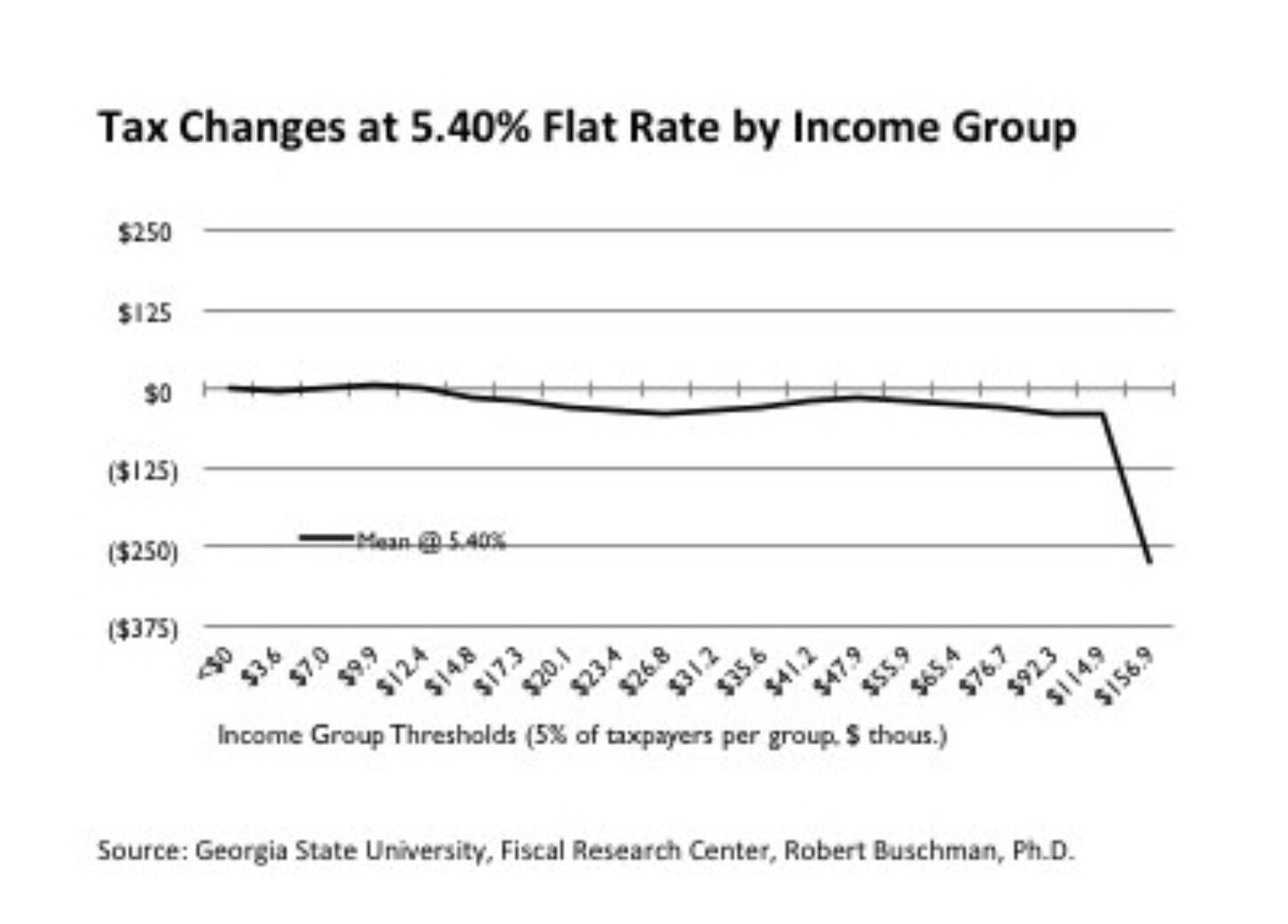

The chart below shows the immediate effect on all taxpayers by income group. The vertical axis represents the change in taxes paid and the horizontal axis represents average income in thousands of dollars. The average change in taxes is either zero change or a tax cut for every income category, even before the rate drops to 5.2% or 5.0%. It’s important to note that nationally more than half of all business income is taxed through the individual income tax, not the corporate income tax. This is because most businesses, 94 percent in 2011, are organized as “pass-throughs” – either Partnerships, Sole Proprietorships or S Corporations. So reducing the personal income tax impacts more than 800,000 small businesses in Georgia.

The fiscal note for the bill estimates the income tax reforms will reduce revenues by $218 million in FY 2018. That amounts to less than 1% of FY 2017 state general fund revenues ($22.5 billion) and less than 0.5% of total FY 2017 expenditures ($47.5 billion).

Other Tax Reform Proposals

Two tax reform proposals to lower Georgia’s income tax rate were introduced last year and could be approved this year.

House Bill 435, sponsored by Reps. B.J. Pak and Brett Harrell, would broaden the personal income tax base by limiting itemized deductions and reduce the tax rate from 6 percent to 5.25 percent. Itemized deductions would be limited to charitable contributions (with no limit) and mortgage interest of up to $20,000.

House Bill 445, sponsored by Rep. John Carson, would reduce the personal and corporate income tax rates from 6 percent to 4 percent over time. The bill has several components:

- The sales tax base is broadened by taxing groceries, digital goods and cable and satellite TV

- The sales tax rate increases from 4 percent to 5 percent

- Cigarette taxes increase from 37 cents a pack to 65 cents a pack

- A number of tax credits are eliminated

You can read more about these plans here: Two Pro-Growth Tax Reform Plans Introduced

The Transportation Funding Act of 2015 created (starting on line 39) a Special Joint Committee on Georgia Revenue Structure and states that this Joint Committee “shall during the 2016 legislative session cause to be introduced in the House of Representatives one or more bills or resolutions relating to tax reform…”

Impact on Bond Ratings

There is a concern that tax reform can harm bond ratings. Obviously, a dramatic reduction in tax revenues would impair a state’s ability to pay back debt, but sound tax reform can actually strengthen the fundamentals that determine a state’s bond rating. Broadening the sales tax base, for example, can enhance growth and lower volatility. Reducing reliance on income taxes can also be a positive. One rating agency, Standard & Poor’s, stated Washington State’s “sales tax-based revenue structure that exhibits sensitivity to economic cycles, but to a lesser degree than those of states that rely primarily on personal and corporate income taxes.” (Washington State does not have an income tax.) Finally, bond rating agencies prefer states to have the flexibility to raise taxes if necessary. Due to a constitutional amendment passed in 2014, Georgia’s personal income tax rate is capped at 6 percent. Therefore, reducing the income tax rate below 6 percent would return that flexibility.

Below is the latest summary of bond ratings from Standard & Poor’s. Notice that North Carolina retained the highest bond rating even after a dramatic round of tax reforms in 2013.

Senate Finance Committee Chairman Judson Hill recently introduced two tax reform bills. The first proposal would replace Georgia’s six tax brackets with one tax bracket of 5.4 percent (a reduction of 10 percent from the current top rate of 6 percent), increase personal and dependent exemptions by $2,000 each, and eliminate itemized deductions other than charitable deductions, medical expenses and up to $25,000 of mortgage interest. In addition, the corporate net worth tax is eliminated. [Update: Analysis of this bill by the Tax Foundation indicates it would improves Georgia’s ranking to 18th overall on the State Business Tax Climate Index, up from the current ranking of 39th.]

The second bill, a proposed constitutional amendment, would reduce the personal income tax rate to 5.2 percent and then to 5.0 percent contingent on state revenues and the Rainy Day Fund meeting specific targets.

How does Georgia’s top marginal personal income tax rate compare to other states? In the Southeast, only South Carolina’s top rate of 7 percent is higher than Georgia. Nationally, 28 states have lower marginal rates.

28 States with Personal Income Tax Rates Lower Than Georgia

| Alaska – 0%

Florida – 0% Nevada – 0% New Hampshire – 0%* South Dakota – 0% Tennessee – 0%* Texas – 0% Washington – 0% Wyoming – 0% Pennsylvania – 3.07% North Dakota – 3.22% |

Indiana – 3.3%

Illinois – 3.75% Michigan – 4.25% Arizona – 4.54% Kansas – 4.6% Colorado – 4.63% New Mexico – 4.9% Alabama – 5% Mississippi – 5% Utah – 5% Massachusetts – 5.15% |

Oklahoma – 5.25%

Ohio – 5.33% North Carolina – 5.499% Maryland – 5.75% Virginia – 5.75% Rhode Island – 5.99% Georgia – 6% Kentucky – 6% Louisiana – 6% Missouri – 6% |

| * NH and TN tax interest and dividends only (not wages). | ||

Although similar to the recommendations of the 2010 Special Council on Tax Reform and Fairness for Georgians and the tax reforms implemented in North Carolina, these proposals are more limited in scope.

Comparing Tax Reform Proposals

| North Carolina 2013 and 2015 Reforms | Georgia Tax Reform Council Recommendations | Georgia Current Law | 2016 Georgia Proposal | |

| Income Tax Brackets | 1 | 1 | 6 | 1 |

| Income Tax Rate(s) | 5.499% | 5% declining to 4% | 1%-6% | 5.4% declining to 5.0% if revenue triggers are met |

| Itemized Deductions | Limited to charitable deductions, medical expenses and up to $20,000 of mortgage interest and real property taxes | Eliminate | Limited to charitable deductions, medical expenses and up to $25,000 of mortgage interest | |

| Standard Deduction | More than doubled to $15,500 for married couples | Eliminate | No change | |

| Personal Exemptions | Eliminated | Eliminate | Increased by $2,000 | |

| Dependent Deduction | Eliminated | Reduce to $2,000 | Increased by $2,000 | |

| Corporate Income Tax Rate | 5% declining to 3% in 2017 if revenue trigger is met | Same as Personal Income Tax rate | 6% | No change |

| Estate Tax | Eliminated | Already eliminated | ||

| Food for Home Consumption (Groceries) | Not taxed | Eliminate exemption | No change (exemption remains in place) | |

| Sales Tax Rate | No change | No change | No change | |

| Sales Tax on Services | Modest expansion to tax service contracts and repair or maintenance services | Tax selected personal and household services | No change | |

| Sales Tax Holiday | Eliminated | Eliminate | No change |

The IRS publishes personal income tax data for each state here. Based on that information, it is possible to calculate the average mortgage interest deduction and average charitable gift deduction for Georgia taxpayers by income. A breakout of medical expense deductions is not available at the state level, so these must be estimated using federal data. The average mortgage interest deduction for the highest income category (adjusted gross income of $1 million or more) is below the proposed cap of $25,000.

| $1 under $10,000 |

$10,000 under $25,000 |

$25,000 under $50,000 |

$50,000 under $75,000 |

$75,000 under $100,000 |

$100,000 under $200,000 |

$200,000 under $500,000 |

$500,000 under $1,000,000 |

$1,000,000 or more |

|

|---|---|---|---|---|---|---|---|---|---|

| Average mortgage interest deduction (Actual GA data) | $7,035 | $6,188 | $5,892 | $6,502 | $7,300 | $8,817 | $13,121 | $18,987 | $22,082 |

| Average charitable gift deduction (Actual GA data) | $1,654 | $2,679 | $3,402 | $3,810 | $4,280 | $5,347 | $9,948 | $30,757 | $170,218 |

| Average allowable medical expense deduction (Estimate based on federal data) | $6,022 | $2,770 | $2,639 | $2,409 | $1,580 | $1,017 | $700 | $552 | $663 |

The table below shows how the taxable income for a family of four in different income categories would change after the proposed tax reform. This shows a reduction in taxable income for families with income below $100,000. The higher income families would see a net increase in their taxable income, but would also benefit the most from the tax rate reduction.

| $1 under $10,000 |

$10,000 under $25,000 |

$25,000 under $50,000 |

$50,000 under $75,000 |

$75,000 under $100,000 |

$100,000 under $200,000 |

$200,000 under $500,000 |

$500,000 under $1,000,000 |

$1,000,000 or more |

|

| Average adjusted gross income (AGI) | $5,597 | $16,947 | $35,825 | $61,379 | $86,562 | $134,542 | $283,801 | $673,029 | $2,523,556 |

| Current personal exemptions and dependent deductions | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 | $13,400 |

| Current average itemized deductions | $14,441 | $14,058 | $15,525 | $19,910 | $20,256 | $25,414 | $43,756 | $91,983 | $331,490 |

| Current estimated taxable Income | $0 | $0 | $6,900 | $28,069 | $52,906 | $95,728 | $226,645 | $567,646 | $2,178,667 |

| After Proposed Tax Reform: | |||||||||

| Increased personal exemptions and dependent deductions | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

| Reduced itemized deductions | $0 | $2,422 | $3,592 | $7,189 | $7,097 | $10,233 | $19,986 | $41,687 | $138,527 |

| Net change in estimated taxable income after tax reform | -$8,000 | -$5,578 | -$4,408 | -$811 | -$903 | $2,233 | $11,986 | $33,687 | $130,527 |

So under this proposal, an average family of four that itemizes would pay no tax on the first $34,000 of income. (Median household income in Georgia is around $49,000. The total deductions and exemptions from the third and fourth columns in the tables above under this proposal are $34.121 and $34,559, respectively.)

The chart below shows the immediate effect on all taxpayers by income group. The vertical axis represents the change in taxes paid and the horizontal axis represents average income in thousands of dollars. The average change in taxes is either zero change or a tax cut for every income category, even before the rate drops to 5.2% or 5.0%. It’s important to note that nationally more than half of all business income is taxed through the individual income tax, not the corporate income tax. This is because most businesses, 94 percent in 2011, are organized as “pass-throughs” – either Partnerships, Sole Proprietorships or S Corporations. So reducing the personal income tax impacts more than 800,000 small businesses in Georgia.

The fiscal note for the bill estimates the income tax reforms will reduce revenues by $218 million in FY 2018. That amounts to less than 1% of FY 2017 state general fund revenues ($22.5 billion) and less than 0.5% of total FY 2017 expenditures ($47.5 billion).

Other Tax Reform Proposals

Two tax reform proposals to lower Georgia’s income tax rate were introduced last year and could be approved this year.

House Bill 435, sponsored by Reps. B.J. Pak and Brett Harrell, would broaden the personal income tax base by limiting itemized deductions and reduce the tax rate from 6 percent to 5.25 percent. Itemized deductions would be limited to charitable contributions (with no limit) and mortgage interest of up to $20,000.

House Bill 445, sponsored by Rep. John Carson, would reduce the personal and corporate income tax rates from 6 percent to 4 percent over time. The bill has several components:

- The sales tax base is broadened by taxing groceries, digital goods and cable and satellite TV

- The sales tax rate increases from 4 percent to 5 percent

- Cigarette taxes increase from 37 cents a pack to 65 cents a pack

- A number of tax credits are eliminated

You can read more about these plans here: Two Pro-Growth Tax Reform Plans Introduced

The Transportation Funding Act of 2015 created (starting on line 39) a Special Joint Committee on Georgia Revenue Structure and states that this Joint Committee “shall during the 2016 legislative session cause to be introduced in the House of Representatives one or more bills or resolutions relating to tax reform…”

Impact on Bond Ratings

There is a concern that tax reform can harm bond ratings. Obviously, a dramatic reduction in tax revenues would impair a state’s ability to pay back debt, but sound tax reform can actually strengthen the fundamentals that determine a state’s bond rating. Broadening the sales tax base, for example, can enhance growth and lower volatility. Reducing reliance on income taxes can also be a positive. One rating agency, Standard & Poor’s, stated Washington State’s “sales tax-based revenue structure that exhibits sensitivity to economic cycles, but to a lesser degree than those of states that rely primarily on personal and corporate income taxes.” (Washington State does not have an income tax.) Finally, bond rating agencies prefer states to have the flexibility to raise taxes if necessary. Due to a constitutional amendment passed in 2014, Georgia’s personal income tax rate is capped at 6 percent. Therefore, reducing the income tax rate below 6 percent would return that flexibility.

Below is the latest summary of bond ratings from Standard & Poor’s. Notice that North Carolina retained the highest bond rating even after a dramatic round of tax reforms in 2013.