A report by the U.S. Government Accountability Office found that the Arkansas Medicaid expansion program cost the state nearly $780 million more in its first three years than traditional Medicaid expansion under the ACA.1https://www.gao.gov/assets/gao-14-689r.pdf

On November 16, 2023, a delegation of current and former Arkansas policymakers testified before the Georgia House Study Committee on CON Modernization. Their presentation focused on Arkansas Medicaid programs since the passage of the Affordable Care Act (ACA), principally the Arkansas 1115 waiver known as the “private option.”

Georgia policymakers may be asked to consider a potential expansion of the state Medicaid program using Arkansas as the model. This brief evaluates the ancillary claims made by proponents of the Arkansas private option, such as the positive effect on health insurance premiums and decreased emergency room utilization for non-emergency cases. The primary source for the research is from the nonprofit public health policy organization KFF (formerly known as the Kaiser Family Foundation). All other sources are indicated otherwise.

What is the Arkansas 1115 Waiver, Commonly Known as the Private Option?

In October 2013, Arkansas launched the country’s first program to cover the ACA’s Medicaid expansion population with private health insurance. State and federal Medicaid funds are used to purchase marketplace coverage through Healthcare.gov for parents with income from 17-138 percent of the federal poverty level and childless adults from 0-138 percent of the federal poverty level. The concept is that Medicaid beneficiaries would get the larger provider networks provided by commercial health insurance, while physicians and other providers would be incentivized to see additional Medicaid patients because commercial plans pay higher reimbursement rates than those offered by the state’s traditional Medicaid Fee for Service (FFS) plan.

The private option model covered roughly 225,000 people when it first launched in January 2014. Since then, the program has grown to cover over 340,000 people within the ACA’s Medicaid expansion population.1 2 Arkansas is the only state that still operates the private option approach after Iowa and New Hampshire both abandoned their models that covered Medicaid expansion beneficiaries through state-purchased health plans on the exchange.

Have Health Insurance Premiums on the Exchange Stabilized in Arkansas?

The answer to this is mixed. While the short-term could be characterized as a success, the long-term outcome has been far less so, and could even be deemed a failure based on language from the original 1115 waiver, which stated that “Premium Assistance will reduce overall premium costs in the Exchange Marketplace and will increase quality of care.”

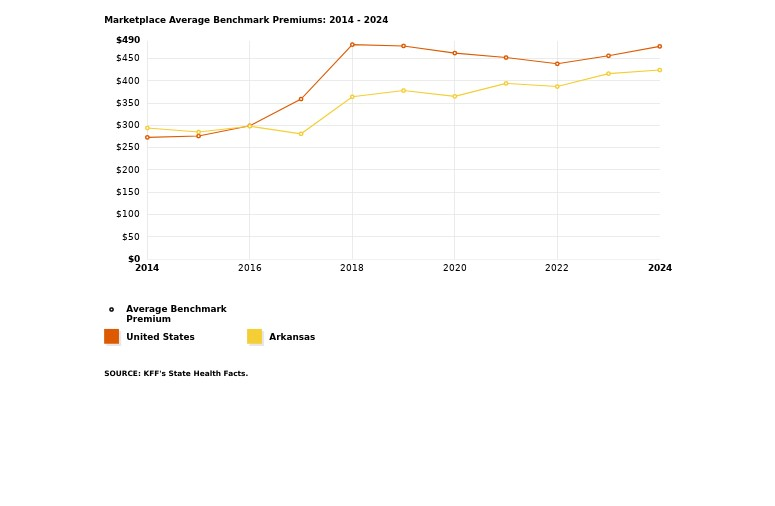

As seen in the chart below, Arkansas enjoyed relatively stable marketplace premiums immediately after implementation of its private option 1115 waiver in 2014 – even experiencing two average price declines in a three-year period for the benchmark premiums offered on the exchange.3

During the period from 2014-2024, the average benchmark premium in Arkansas has increased by 44 percent, from $294 to $424. By comparison, the average benchmark premium in the U.S. increased by 74 percent, from $273 to $477, from 2014-2024. For additional reference Georgia, which is not depicted in the chart above, experienced a 59 percent increase during the same period, from $291 to $463.

However, even considering this relative success at stabilizing the market in the early years after implementation, a report by the Office of the Assistant Secretary for Planning and Evaluation found that Arkansas ranked only 29th at keeping premiums down (128 percent increase) out of the 39 states it reviewed on the federal exchange from 2013-2017.4

As presented by the Arkansas delegation in their testimony before the House Study Committee, “Over 225,000 adults are thus integrated with the privately insured risk pool. By spreading the risk across a larger group of people who tend to be younger and healthier (33 percent less than 30 years old), Marketplace rates are lower and more stable than in other states.”5 However, Arkansas currently ranks 13th for lowest average benchmark premium in the country for 2024, and the premium assistance model has not reduced overall premium costs in the Exchange Marketplace since its implementation.

Has Non-Emergent Use of the Emergency Room Decreased?

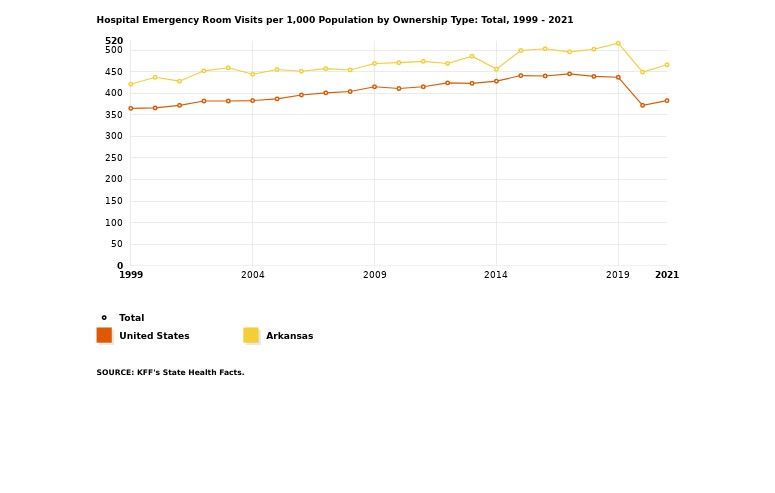

The answer to this appears to be overwhelmingly no. While the data show a 6 percent decrease in overall ER usage during the first year of implementation, this was an outlier. Emergency room utilization in Arkansas almost immediately rebounded and continued to rise in the subsequent decade after the Medicaid private option was enacted.

In principle, both those who favor Medicaid expansion and those opposed (to all of its various forms over a decade after the enactment of the Affordable Care Act) should agree that increased access to primary care is a desirable outcome. Theoretically, the increase of Medicaid patients being reimbursed at commercial insurance rates will lead to a rise in primary care physician acceptance rates and access, and should correlate with a decrease in emergency room use. This is outlined in the Arkansas 1115 waiver: “Premium Assistance beneficiaries will have lower non emergent use of emergency room services.”6

The chart below measures emergency room visits per 1,000 population from 1999-2021, for all hospitals and all patients. Arkansas remained higher than the national average for emergency room utilization both before and after implementation of the private option. Notably, even the trends in emergency room usage data mirrored each other during the COVID-19 pandemic as patient behavior changed and hospitals both in Arkansas and nationally adopted new protocols.

While some existing research on the Arkansas model has attempted to quantify non-emergent use by private option beneficiaries using hospital survey data, there is a lack of consensus on what often constitutes emergency care.7 Furthermore, a program that now covers roughly 10 percent of Arkansans should be adequately reflected in overall emergency room utilization.

According to one study, Arkansas physicians are over 30 percent more likely to accept Medicaid patients than their counterparts in Georgia.8 However, this has not resulted in a statistically significant decrease in overall emergency room utilization in the state. Even with a sudden decrease after the implementation of the Medicaid private option, overall ER usage returned to its previous trajectory.

What Does It Cost the State?

Similar to Georgia’s Aged, Blind and Disabled (ABD) Medicaid population, Arkansas has a “medically frail” evaluation for those with disabling mental disorders, including serious mental illness; chronic substance use disorders; serious and complex medical conditions; and physical, intellectual or developmental disabilities.9 Both of these populations are covered under traditional Fee for Service (FFS) reimbursement in which health care providers are paid for each test and service performed during healthcare visits. Nearly all other Medicaid recipients, including low-income adults and children, foster care children, and pregnant women, are covered through Georgia’s Medicaid managed care program, Georgia Families.

A report published by the Foundation for Government Accountability in 2020 found that traditional Medicaid enrollees – those needing the most medical care — are “still cheaper to cover than enrollees in private option plans: In 2018, private option enrollees cost [Arkansas] taxpayers nearly $7,000 per person. But the adults who were put into fee-for-service Medicaid cost $5,300 per person, even though the state indicated that these enrollees were specifically excluded from the private option because they had significantly greater health needs. This indicates that taxpayers are spending more to cover the healthiest expansion enrollees through the private option than it costs to cover even the sickest expansion enrollees through fee-for-service Medicaid.”10

Even before considering this expansion to cover able-bodied adults, Georgia is currently failing those who need healthcare coverage the most. There are over 7,000 Georgians with intellectual and developmental disabilities on the waiting list to receive traditional Medicaid benefits.11

What About Other States with Private Option Programs?

Iowa, which implemented a similar private option waiver in 2014, closed their program in July 2015, less than two years after it opened. During that time the Medicaid expansion waiver resulted in “double-digit premium hikes, one carrier becoming insolvent, both carriers eventually leaving the program, skyrocketing enrollment, cost overruns, and changes that make Medicaid enrollees less accountable.”12

New Hampshire had its own premium assistance waiver, purchasing private health plans for the Medicaid expansion population. This program ran for three years, from 2016-2018, before New Hampshire legislators, due to cost overruns, voted for the state to transition the expansion population to a regular Medicaid managed care model in 2019.13

- https://files.kff.org/attachment/fact-sheet-medicaid-state-AR

↩︎ - https://www.healthinsurance.org/medicaid/arkansas/ ↩︎

- Benchmark premiums are an industry standard term for the second-lowest cost Silver plan offered on the exchange in a county. For additional information: https://www.kff.org/health-reform/state-indicator/marketplace-average-benchmark-premiums/ ↩︎

- https://aspe.hhs.gov/sites/default/files/migrated_legacy_files//174771/IndividualMarketPremiumChanges.pdf ↩︎

- https://www.house.ga.gov/Documents/CommitteeDocuments/2023/Certificate_of_Need/November%2016/AR%20Medicaid%20Assistance%20Program-%2011.16.23.pdf ↩︎

- https://humanservices.arkansas.gov/wp-content/uploads/710-19-1020_Attachment_J3.pdf ↩︎

- https://aspe.hhs.gov/sites/default/files/private/pdf/265086/ED-report-to-Congress.pdf ↩︎

- https://www.shadac.org/news/14-17-physician-Mcaid-SHC ↩︎

- https://www.kff.org/report-section/disability-and-technical-issues-were-key-barriers-to-meeting-arkansas-medicaid-work-and-reporting-requirements-in-2018-issue-brief/ ↩︎

- https://thefga.org/wp-content/uploads/2020/10/Arkansas-so-called-conservative-approach-to-ObamaCare-expansion-has-failed.pdf ↩︎

- https://www.kff.org/medicaid/state-indicator/medicaid-hcbs-waiver-waiting-list-enrollment-by-target-population-and-whether-states-screen-for-eligibility/ ↩︎

- https://www.forbes.com/sites/theapothecary/2015/09/14/iowa-scraps-waiver-for-obamacare-medicaid-expansion/?sh=58da1d0b5d5c ↩︎

- https://www.healthinsurance.org/medicaid/new-hampshire/ ↩︎