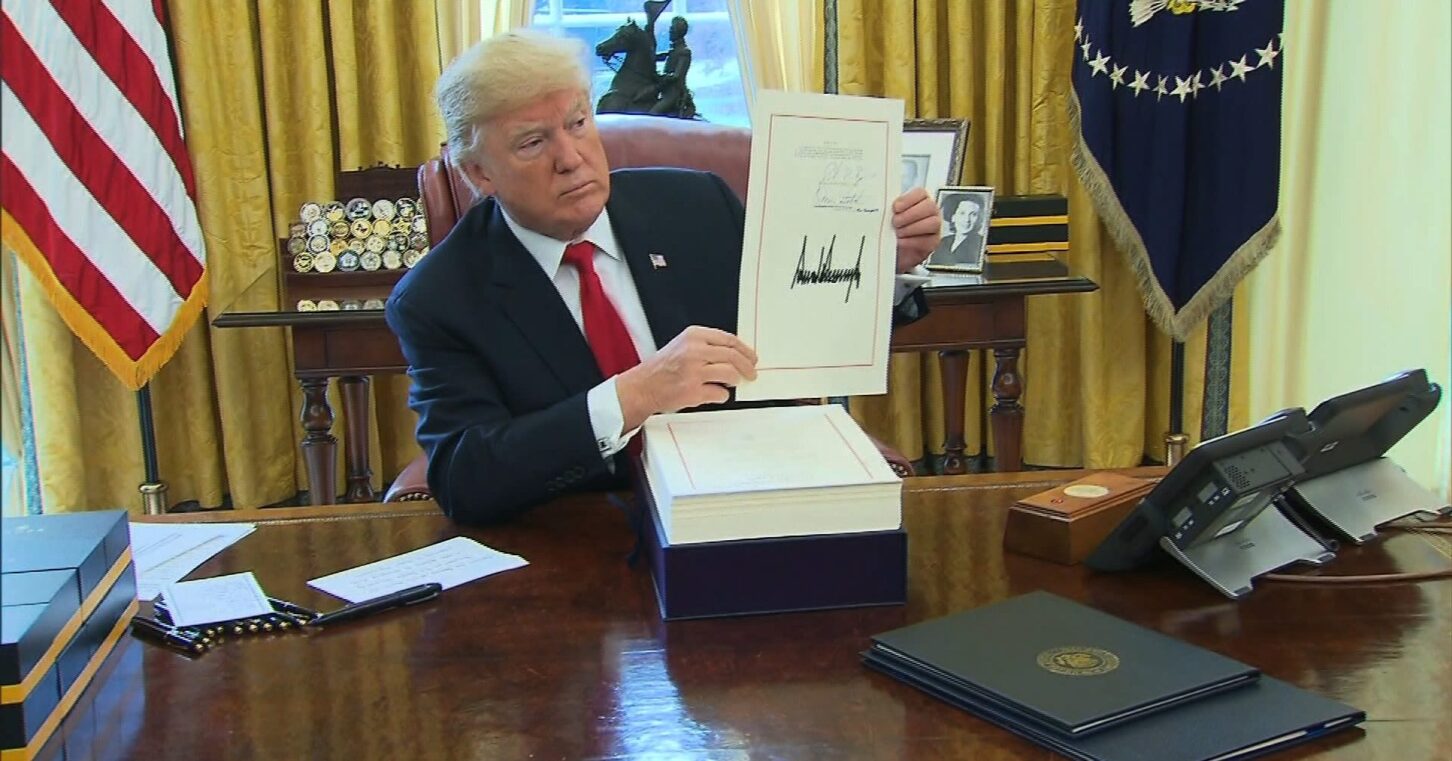

If the individual provisions of the Tax Cuts and Jobs Act (TCJA) expire at the end of next year, tax filing will get more complicated for millions of Americans.

The TCJA simplified tax filing through two main channels: encouraging taxpayers to take the standard deduction and raising the threshold for the alternative minimum tax.

Taxpayers have the choice of taking the standard deduction or using itemized deductions. Itemized deductions allow taxpayers to deduct different specific expenses—most notably mortgage interest, state and local taxes (SALT), and charitable contributions—to reduce their taxable income. Meanwhile, the standard deduction is a flat deduction available to all taxpayers.

Higher-income taxpayers more often utilize itemized deductions as they tend to (among other things) make higher charitable contributions, pay more in mortgage interest, and pay higher state and local taxes, making itemizing more advantageous than taking the flat standard deduction. However, complying with itemized deductions takes more work.

The TCJA shifted people to the simpler standard deduction thanks to a few major changes. First, the law nearly doubled the standard deduction, from $6,500 to $12,000 for single filers and from $13,000 to $24,000 for joint filers, both of which have since been indexed for inflation each year, while suspending personal exemptions. These changes were also connected to a broader reform of how the tax code treats families, which included an expansion of the child tax credit. The law also limited two major itemized deductions, capping the SALT deduction at $10,000 per taxpayer and reducing the limit on mortgage interest from interest on $1 million of principal to $750,000. It also eliminated miscellaneous itemized deductions.

The TCJA’s effect on complexity is clear. In 2017, 46.8 million tax returns claimed itemized deductions, translating to 30.6 percent of individual tax returns. Following tax reform in 2018, only 17.5 million individual tax returns claimed itemized deductions, or 11.4 percent. The share of taxpayers itemizing has hovered around 10 percent since, after staying relatively steady near 30 percent of returns in previous decades.

The individual alternative minimum tax (AMT) is a separate tax system some taxpayers must use to calculate another potential tax liability. The AMT was originally intended to prevent high-income taxpayers from using too many deductions to reduce their taxable income. It requires taxpayers to add back several deductions and other tax items, allows an AMT exemption (that phases out for higher earners), and then applies lower tax rates. While the AMT has some laudable goals, it is a poor substitute for direct reforms to tax deductions themselves, and, unsurprisingly, adding a second tax system creates more complexity for taxpayers. Additionally, in 2016, about 89 percent of AMT filers earned under $500,000.

The TCJA increased the AMT’s exemption and dramatically raised the exemption’s phaseout threshold. For the 2024 tax year, the AMT’s exemption is $85,700 for single taxpayers and $133,300 for joint taxpayers, while the exemption phaseout threshold is $609,350 for single taxpayers and $1,218,700 for joint taxpayers. These amounts are indexed to inflation each year.

The reforms to the AMT have substantially reduced the number of taxpayers subject to the AMT. In 2017, 5 million taxpayers were subject to the AMT, or 3 percent of returns. In 2018, only 250,000 taxpayers were subject to the AMT. Furthermore, the reduction in taxpayers paying the AMT does not tell the full simplification story. In addition to the AMT taxpayers, other taxpayers must also calculate their liability under the AMT to see if they must pay it. Before TCJA, 10 million taxpayers had to calculate their potential AMT liability, while now only roughly 5.7 million must, as of 2021.

In 2018, a Tax Foundation study estimated the changes to the standard deduction and itemized deductions saved taxpayers between $3.1 billion and $5.4 billion per year in compliance costs. Meanwhile, the reduced burden of AMT filing saved taxpayers an estimated $4.6 billion, meaning total simplification benefits of potentially $10 billion per year (worth more today due to inflation and growth in the economy). If the TCJA changes are allowed to expire, more taxpayers would be pushed into more complex tax filing situations, increasing overall compliance costs by billions of dollars.

While the TCJA simplified the tax code on net for most personal income taxpayers, the business side is more of a mixed bag, and that is where much of the tax code’s complexity lies. For instance, the TCJA’s new 20 percent pass-through deduction is quite complex. Policymakers created the deduction to provide tax benefits for pass-through businesses (businesses taxed through the personal income tax) because the corporate rate reduction did not apply to them. However, this provision needed to come with complicated backstops to prevent individuals from reclassifying labor income as business income. As a result, the provision has created substantial new compliance costs: according to a brand-new Tax Foundation study, the pass-through deduction will create just over $19 billion in compliance costs.

Other than the pass-through deduction, the TCJA didn’t substantially change business tax complexity on net. The TCJA did eliminate a major tax expenditure, the domestic production activities deduction. However, it also introduced research and development (R&D) amortization, which has added complexity and penalized investment by requiring companies to spread deductions for R&D costs out over five years. The TCJA also substantially changed international taxation, ultimately replacing one complex system with another.

Nonetheless, the structural bones of the TCJA’s individual tax reforms constitute a substantial improvement for most taxpayers. But reversing the limits to the AMT and the greater use of the standard deduction would not just hurt taxpayers; it could also create more technical challenges for the IRS’s new Direct File program. At this point, Direct File can only serve simple tax returns, which (among other limitations) must take the standard deduction, not itemized deductions. If the TCJA’s individual provisions are allowed to expire and itemized deductions become more valuable for more taxpayers, that could slow down potential uptake for the IRS’s free direct filing program, reducing cost savings for taxpayers. More generally, a more complex tax code is more difficult for the IRS to administer as well.

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

Alex Muresianu is a Senior Policy Analyst at the Tax Foundation, focused on federal tax policy.