Montana’s plan was in severe financial trouble at the beginning of 2015, and its turnaround holds lessons for other states, including Georgia.

The Montana State Employee Group Health Plan covers 31,000 lives: 12,700 state employees and legislators, 2,000 retirees, and 16,300 dependents. As with many other state employee benefit plans, it is the largest self-funded plan in the state. The plan was in severe financial trouble at the beginning of 2015, and its turnaround holds lessons for other states, including Georgia.

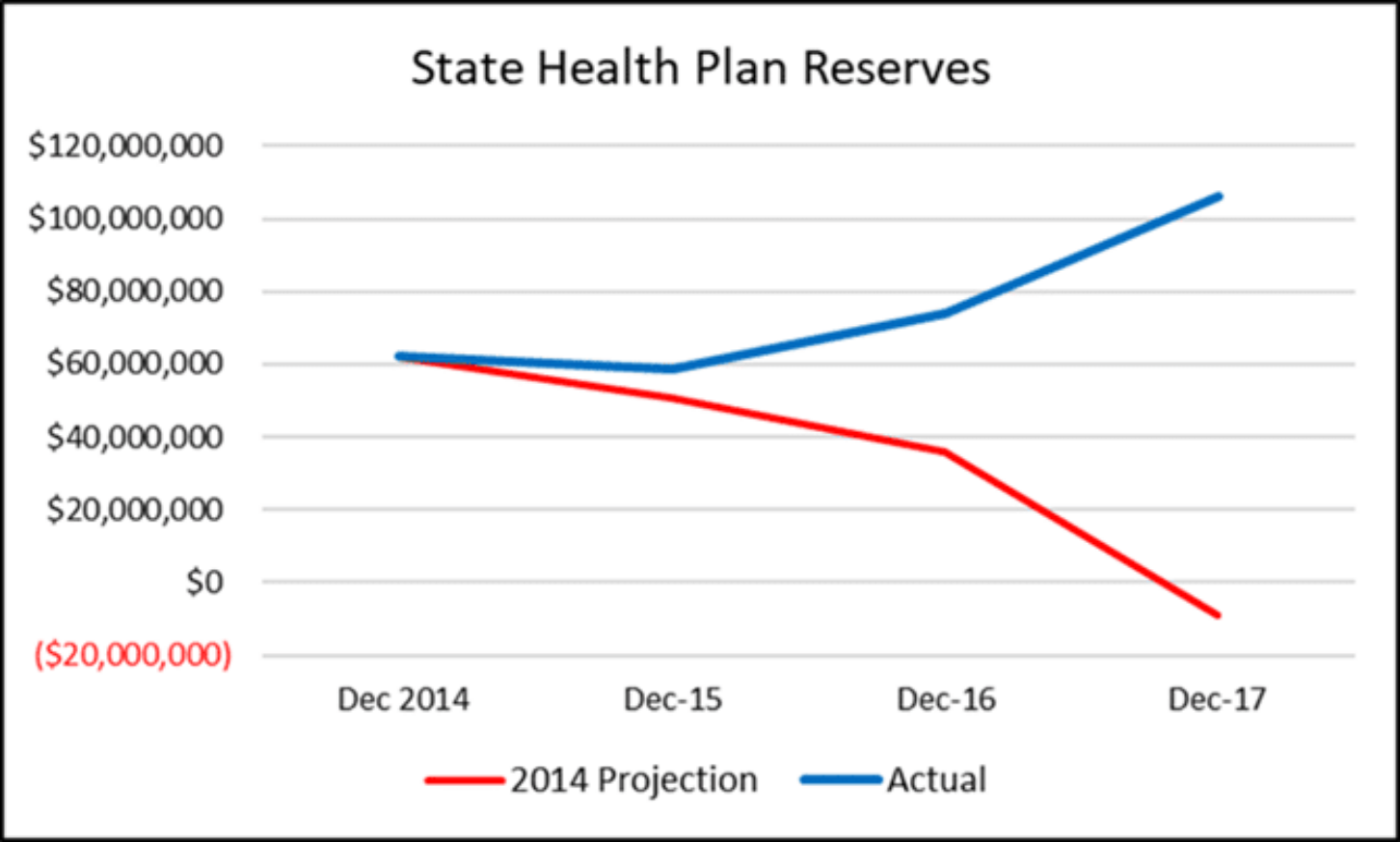

The plan had lost $28 million in 2014. Based on an actuarial projection showing plan reserves at minus $9 million in 2017, the Governor’s Office and the Legislature passed legislation in 2015 that directed the Plan Administrator move the plan to a positive reserve balance within two years. The Plan Administrator would report progress to the Governor’s Office and Montana’s Senate Finance Committee over the interim period.

The state hired me as its new Plan Administrator, with the directive to increase plan reserves, minimize the impact on benefits for plan members and “consider specific cost containment measures.” I analyzed financials and cost drivers and moved quickly to disrupt the status quo. The work paid off: Reserves reached a positive balance of $112 million in 2017.

So, what changed?

- The state terminated contracts with the existing Third Party Administrator, Pharmacy Benefit Manager and consulting firm, then placed new vendors under transparent, lower-cost contracts.

- The state terminated duplicate services, eliminating $5.5 million in duplicate wellness programs.

- An analysis of medical claims showed the plan had previously paid up to 322% of Medicare Inpatient Rates and up to 611% of Medicare Outpatient Rates at the 11 Montana acute-care hospitals, comprising 87% of the plan’s Montana’s hospital expenses.

The plan negotiated separate contracts with all Montana hospitals to reimburse inpatient, outpatient and physician services as a multiple of Medicare instead of the standard discount off charge master rates, which are prices set by the hospitals. The contracts set the multiple between 220% and 250% and prevented balance billing (charging consumers the difference between what insurance pays and the hospital charges for covered services) to plan members.

- As Plan Administrator, I implemented transparent, pass-through pharmacy benefits that gave the plan all rebates, eliminated spread pricing and lowered administrative fees. In just the first year, the move saved 23% in pharmacy benefit spending.

- Five onsite health clinics offered plan members primary care services with no copay, longer appointment times and no-cost laboratory testing. The clinic offerings were enhanced with third party contracts for ancillary services at significant lower costs, additional health coaching staff, and increased utilization by allowing other public employers to participate in the clinics.

- The state implemented a third-party, cloud-based data warehouse and data analytics system that gave the plan complete ownership of and access to its claims data, and enabled it to manage claims costs and benefit offerings more effectively.

- An online, third-party, cloud-based Plan Enrollment and Administration system replaced costly State Information Technology charges and hundreds of manual processes.

As a result of these measures, plan members and the state have seen no rate increases for five years – 2017 through 2021. Meanwhile, plan members are receiving enhanced benefits: The Summary Plan Description (SPD) was redrafted, out-of-pocket requirements were frozen, and additional services are being offered through the Montana health centers.

The state’s Other Post Employment Benefit Liability (OPEB) for health benefits was reduced from $374 million in 2015 to $54 million by 2017. In fact, the health plan reserves were greater than the Montana General Fund in 2017, prompting the Legislature to approve a $25 million employer premium holiday, reducing Plan Reserves to benefit the State budget. At the end of 2019, the plan was still doing well, with $54 million above actuarily required reserves.

At a time when budgets in Georgia and elsewhere are under pressure due to the recession, states would be very wise to adopt these reforms to their own health plans. Given that Georgia’s State Health Benefit Plan now accounts for about $5 billion in state spending, the savings could be substantial. Not only will taxpayers save money, but employees will save money while receiving better services. That’s the kind of win-win-win Georgians deserve.