While breweries are contributing to economic growth in many states, Georgia is being held back by antiquated laws and powerful special interests.

The growing number of wineries in north Georgia are becoming a tourism success story. Visitors can tour the winery, sample the products and then buy a bottle, or a case, to take home. If you really like the wine, you can have up to 12 cases a year shipped to your home.

Craft beer is the latest craze. Breweries are springing up all over the state of Georgia. While breweries are contributing to economic growth in many states, Georgia is being held back by antiquated laws and powerful special interests.

Georgia is one of 5 states where breweries cannot sell beer directly to consumers. Brewers in Georgia simply want to be treated the same as Georgia wineries and breweries in 45 other states.

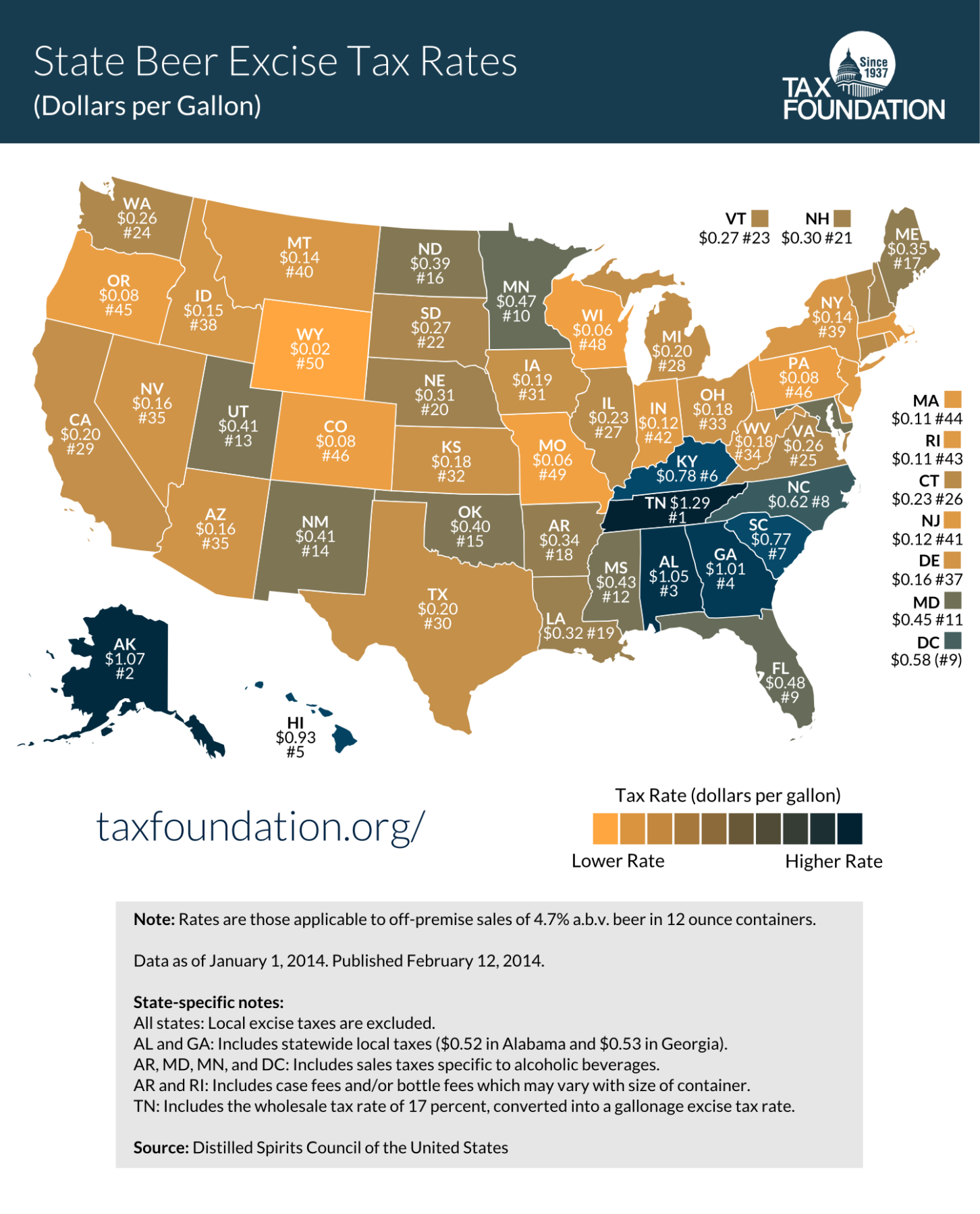

A proposal introduced by Senator Hunter Hill, Senate Bill 63, would allow brewpubs and breweries to sell up to 144 ounces of beer per person to go (equivalent to two six packs) and up to 72 ounces per person for on-site consumption. The bill requires that prices must be similar to retail prices and the appropriate taxes must be paid. (Georgia already has the 4th highest tax on beer in the nation at $1.01 per gallon. See map below.)

This reasonable proposal would help level the playing field and help these small businesses grow and create jobs. Georgia should avoid developing a reputation for overregulation and picking winners and losers based on campaign contributions.

The growing number of wineries in north Georgia are becoming a tourism success story. Visitors can tour the winery, sample the products and then buy a bottle, or a case, to take home. If you really like the wine, you can have up to 12 cases a year shipped to your home.

Craft beer is the latest craze. Breweries are springing up all over the state of Georgia. While breweries are contributing to economic growth in many states, Georgia is being held back by antiquated laws and powerful special interests.

Georgia is one of 5 states where breweries cannot sell beer directly to consumers. Brewers in Georgia simply want to be treated the same as Georgia wineries and breweries in 45 other states.

A proposal introduced by Senator Hunter Hill, Senate Bill 63, would allow brewpubs and breweries to sell up to 144 ounces of beer per person to go (equivalent to two six packs) and up to 72 ounces per person for on-site consumption. The bill requires that prices must be similar to retail prices and the appropriate taxes must be paid. (Georgia already has the 4th highest tax on beer in the nation at $1.01 per gallon. See map below.)

This reasonable proposal would help level the playing field and help these small businesses grow and create jobs. Georgia should avoid developing a reputation for overregulation and picking winners and losers based on campaign contributions.